You are here:Bean Cup Coffee > block

Bitcoin and the Crypto Market Has Bottomed Out: Binance's Perspective

Bean Cup Coffee2024-09-20 23:39:20【block】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent months, the cryptocurrency market has experienced a rollercoaster ride, with Bitcoin and o airdrop,dex,cex,markets,trade value chart,buy,In recent months, the cryptocurrency market has experienced a rollercoaster ride, with Bitcoin and o

In recent months, the cryptocurrency market has experienced a rollercoaster ride, with Bitcoin and other digital assets facing significant volatility. However, many experts and investors are now saying that the crypto market has bottomed out, and Binance, one of the largest cryptocurrency exchanges, has echoed this sentiment. In this article, we will discuss the factors that have led to this conclusion and Binance's role in the crypto market's recovery.

Firstly, it is essential to understand the reasons behind the crypto market's downturn. The bearish trend began in early 2022 when Bitcoin and other digital assets experienced a sharp decline in value. Several factors contributed to this downturn, including regulatory concerns, inflation fears, and the overall economic uncertainty caused by the COVID-19 pandemic.

However, as the market continues to stabilize, many experts believe that the crypto market has bottomed out. One of the key indicators is the increase in trading volume on Binance, which has seen a significant rise in recent months. This surge in trading activity suggests that investors are once again confident in the crypto market and are ready to invest in digital assets.

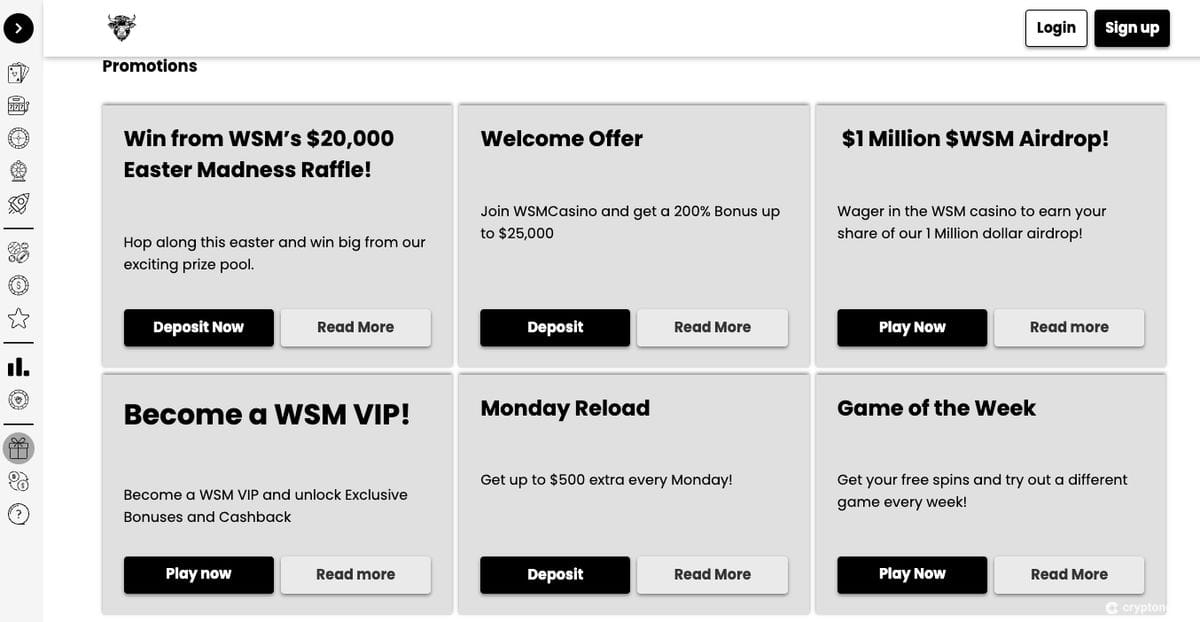

Binance, as one of the leading cryptocurrency exchanges, has played a crucial role in the crypto market's recovery. The platform has been at the forefront of innovation, offering a wide range of services, including trading, staking, and liquidity mining. By providing these services, Binance has made it easier for investors to enter and exit the market, which has contributed to the market's stability.

Moreover, Binance has been actively involved in promoting the adoption of cryptocurrencies. The exchange has launched various initiatives, such as the Binance Smart Chain (BSC), which aims to provide a more efficient and scalable blockchain platform. By doing so, Binance has helped to address some of the key challenges faced by the crypto market, such as high transaction fees and slow processing times.

Another factor that has contributed to the crypto market's bottoming out is the increasing institutional interest in digital assets. Many institutional investors have started to allocate a portion of their portfolios to cryptocurrencies, driven by the potential for high returns and diversification. This trend has been further accelerated by the launch of Bitcoin futures and other financial products that allow institutional investors to gain exposure to the crypto market without owning the underlying assets.

Furthermore, the global economic landscape has also played a role in the crypto market's recovery. Central banks around the world have been implementing expansionary monetary policies, which have led to increased inflation and a weaker US dollar. In this context, Bitcoin and other digital assets have emerged as a potential hedge against inflation and currency devaluation.

In conclusion, the crypto market has bottomed out, and Binance has played a significant role in this recovery. The exchange's innovative services, active promotion of cryptocurrency adoption, and increasing institutional interest have all contributed to the market's stability. As the crypto market continues to evolve, it is crucial for investors to stay informed and adapt to the changing landscape. With the right approach, investors can capitalize on the potential opportunities presented by the crypto market and benefit from its growth.

This article address:https://www.nutcupcoffee.com/blog/57c2799915.html

Like!(93921)

Related Posts

- The World's Single Biggest Bitcoin Wallet: A Treasure Trove of Cryptocurrency

- Bitcoin Price is Falling: What It Means for Investors and the Market

- Mega Bitcoin Mining App: A Game-Changer in Cryptocurrency Mining

- Bitcoin Price Prediction September: What to Expect in the Next Month

- Is Bitcoin Gold Wallet Safe: A Comprehensive Guide

- Mega Bitcoin Mining App: A Game-Changer in Cryptocurrency Mining

- Binance.US BNB to Metamask: A Comprehensive Guide

- How to Setup a Bitcoin Hardware Wallet: A Comprehensive Guide

- Antminer Bitcoin Mining Rigs: The Ultimate Tool for Cryptocurrency Mining

- Worst Bitcoin Wallets: A Comprehensive Guide to Avoiding Them

Popular

Recent

How to Add Binance Smart Chain to Metamask Wallet: A Step-by-Step Guide

**Binanca Coin: A New Era in Cryptocurrency

Title: A Comprehensive Review of Exodus: The Best Bitcoin and Altcoin Wallet on https://99bitcoins.com

Bitcoin ATM Machines in Alberta, Canada: A Gateway to Cryptocurrency Convenience

Binance Average Withdrawal Time ETH: What You Need to Know

The Future Price of Bitcoin 2019: A Comprehensive Analysis

**Earn Money with Bitcoin Mining: A Comprehensive Guide

Will Binance US List Shiba Inu? A Potential Game-Changer for Crypto Investors

links

- Binance Trade Types: A Comprehensive Guide

- Bitcoin Volume by Price: Understanding the Dynamics of the Cryptocurrency Market

- Bitcoin Mining Complexity: A Comprehensive Analysis

- Bitcoin Mining Complexity: A Comprehensive Analysis

- Bitcoin Cash 30 Rates: A Comprehensive Analysis

- Coinbase How to Get Your Bitcoin Cash Satoshi Vision: A Comprehensive Guide

- Title: Unveiling the Mystery: How to Trace a Bitcoin Wallet Address

- Cash Bitcoin in India: A Growing Trend in the Cryptocurrency Landscape

- i can't find shiba on binance: A Comprehensive Guide to Exploring Alternative Platforms

- Bitcoin Volume by Price: Understanding the Dynamics of the Cryptocurrency Market